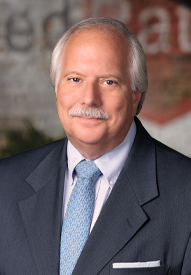

About Bob Federici

I began my career in Banking and Finance and spent over 22 years in International Banking. The past 20 years I have utilized my strong financial background and worked diligently in the Mortgage Industry. I believe that my education and specialization in finance are a perfect fit to work in this industry and provide first class service to my clients. I fully understand the challenges that our young borrowers face while trying to achieve the American Dream. I have a passion to satisfy the needs of our clientele and will take as much time as needed while guiding them through every step of the Mortgage process. I pride myself on the level of dedication and integrity that I deliver to our customers and referral partners. In addition, I remain in constant contact with all of our specific referral partners, as we are all working together for the benefit of the client. I am driven by the strong relationships that have helped me build my business. My business continues to grow with the reputable partner referral base and a steady flow of "word of mouth "referrals. My philosophy is based on establishing a relationship with our colleagues and partners, and not just closing deals. As a resident of Dix Hills for over 30 years, I have a great understanding of how important strong school districts, town services and a variety of community services mean to our homeowners. I have raised 3 children in this neighborhood and have been extremely satisfied with the education agenda as well as the special extracurricular activities. I am aware of the importance of strong schools and stimulating social activities that our new young homeowners are attempting to find. Even though I am available 24/7 to my clients, I very much enjoy spending time with Family, especially my 2 Grandchildren. I am a big sports fan and try to hit the links as time permits.

We're in your pocket

We're committed to you as a whole person, from financial to physical and emotional wellness. Get the Rate experience in a convenient app to fit your lifestyle on-the-go.

Located at 750 Lexington Ave, Suite 2010 New York NY, 10022