About Nathan Steiner

Nathan started in the mortgage industry 20 years ago as a junior in college while attending Michigan State University. Since then he has helped hundreds of families each year to accomplish their personal and financial goals. He takes a consultative approach for each of his clients and works to structure a plan that is specific to their needs. Some of the most common products he offers include Conventional, Jumbo, VA, FHA, and construction financing. As a seasoned lender, there is not much he hasn't seen before. His clients and referral partners value this experience and find comfort knowing if they have an uncommon financial background, he knows exactly how to advise them. When he is not busy assisting clients, he enjoys spending time with his wife and their active 3 boys. Some of his favorite activities are skiing, spending time on Lake St Clair and training for Ironman triathlons. Beyond his involvement as his son's baseball and soccer coach, his commitment to his community is demonstrated through his support of several organizations. He serves as the Director of the Chamber of Commerce and the Nominating Chair of the Grosse Pointe Farms Foundation. As a Grosse Pointe native he strives to make an impact on his community and leave a lasting impression for anyone he meets. For many, purchasing a home is one of the biggest investments you make in a lifetime. Nathan is committed to making that process an easy one. If you are looking to buy or refinance your home please don't hesitate to give him a call. Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee. Restrictions may apply, contact Rate for current rates and for more information. Rate, Inc. is a private corporation organized under the laws of the State of Delaware. It has no affiliation with the US Department of Housing and Urban Development, the US Department of Veterans Affairs, the US Department of Agriculture or any other government agency.

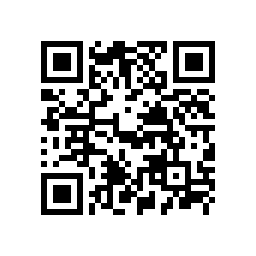

We're in your pocket

We're committed to you as a whole person, from financial to physical and emotional wellness. Get the Rate experience in a convenient app to fit your lifestyle on-the-go.

Located at 86 Kercheval Avenue, Grosse Pointe Farms MI, 48236