About Patti O'Connor

Patti O'Connor is a highly experienced Loan Officer based in Washington DC, with an impressive track record spanning over 20 years in the industry. As an originator, she is dedicated to fully understanding her clients' financial needs and possesses the knowledge and resources necessary to help them secure a mortgage that aligns perfectly with their requirements. With her role as an Executive Finance Manager, Patti has three fundamental goals that guide her approach. First and foremost, she aims to address any and all questions her clients may have regarding mortgage financing, ensuring they have a comprehensive understanding of the process. By simplifying the home financing experience, Patti strives to provide her clients with a seamless journey while maintaining a superior level of service. Building trusting relationships with her clients and their families is another key aspect of Patti's work. She understands the importance of establishing rapport and mutual understanding, fostering an environment where open communication and collaboration flourish. By prioritizing these relationships, Patti creates an atmosphere of trust and confidence, allowing her clients to feel supported throughout the mortgage process. Above all, Patti's ultimate objective is to guide her clients to the settlement table on time, ensuring their satisfaction and minimizing any surprises along the way. With her wealth of experience and attention to detail, she orchestrates each step of the mortgage journey meticulously, leaving no room for unexpected obstacles. Patti O'Connor's dedication, expertise, and commitment to providing exceptional service make her a trusted advisor for individuals seeking a mortgage in Washington DC. Whether you are a first-time homebuyer or a seasoned investor, Patti is the Loan Officer you can rely on to make your home financing experience smooth, informative, and ultimately rewarding.

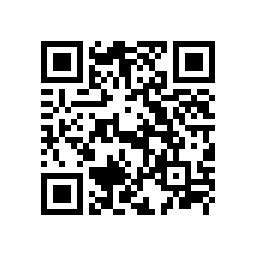

We're in your pocket

We're committed to you as a whole person, from financial to physical and emotional wellness. Get the Rate experience in a convenient app to fit your lifestyle on-the-go.

Located at 10320 Little Patuxent Pkwy, Suite 1140 Columbia MD, 21044