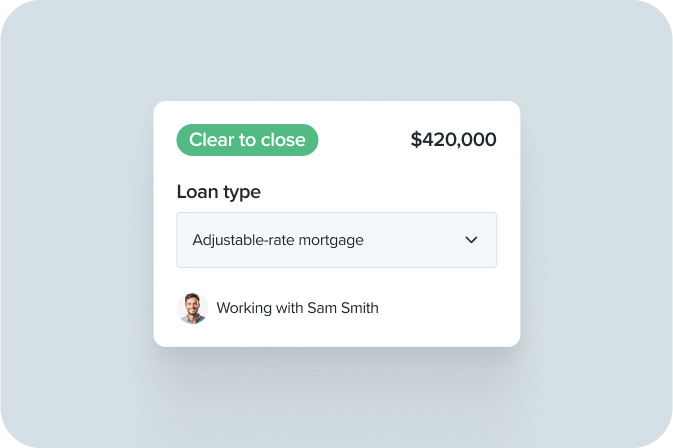

Adjustable-rate mortgage benefits & guidelines

Adjustable-rate mortgages (ARMs) could help you save on interest payments for the first five to 10 years of your loan. The main difference between an adjustable-rate mortgage and a fixed-rate mortgage is the risk involved, so it’s important to understand how an ARM works.

.png)

Why choose an adjustable-rate mortgage?

With ARMs, you benefit from a low, fixed interest rate for an introductory period. While ARMs carry risk during the adjustable period as rates change in response to market conditions, the savings during the initial fixed-rate phase can outweigh increases for some borrowers.

Adjustable-rate mortgage guidelines

To qualify for an ARM, you will need:

- Credit score verification

- Income verification

- Cash on hand for a down payment

Since ARM rates could make the first decade of homeownership more affordable, this type of loan can unlock more housing options for you. While the adjustable period comes with some level of unpredictability, understanding when and how adjustments are calculated can help you decide if this loan fits your goals.

How to apply for an adjustable-rate mortgage

Applying for an adjustable-rate mortgage is simple with Rate’s Digital Mortgage. Follow these steps.

1. Review your finances

Check your credit score, income, and cash on hand for a down payment.

2. Gather key documents

You’ll need to provide income verification, tax returns, asset statements and personal identification.

3. Apply online

Once you submit your application, your Loan Officer will help you from there.

.png)

“Once we found our dream house, they jumped into action and organized everything amazingly efficiently. They stayed calm, cool, and collected and kept us stress free! They never gave us a reason to doubt their abilities, skill, or knowledge, and it truly paid off for us!”

Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee. Restrictions may apply.

Savings, if any, vary based on the consumer’s credit profile, interest rate availability and other factors. Contact Rate for current rates. Restrictions apply.

.png)

.png)

.png)

.png)

![[Cloned 08/13/25 13:29]: testimonial - zillow](https://images.contentstack.io/v3/assets/blt4bf507db5c9bc5ae/blt117adfb03be9f144/687ab60580a8861e82d97030/zillow_logo-png.png)