What is an amortization schedule?

After your loan application is approved, it’s time to put together a repayment plan. Luckily, lenders can’t leave you in the dark when it comes to your loan balance and scheduled payment breakdown. Your lender will provide what’s known as an amortization schedule to guide you through your mortgage repayment.

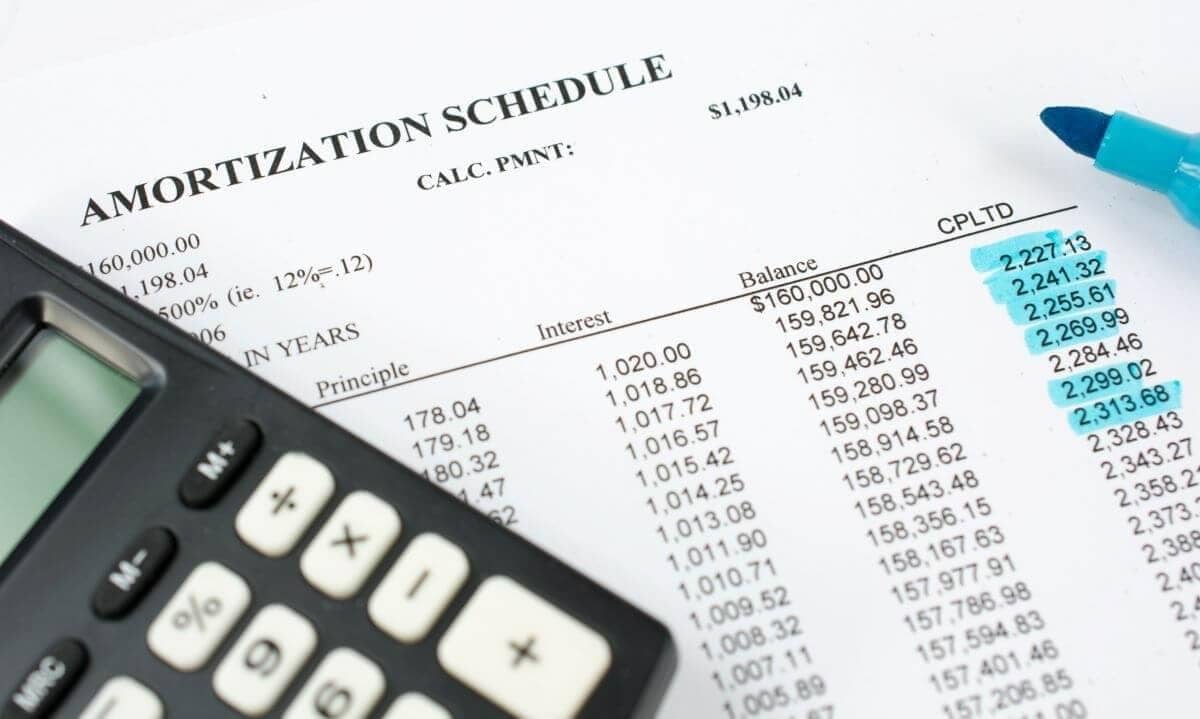

Amortization schedules provide borrowers with a table that outlines periodic loan payments as well as a monthly payment breakdown to show how the loan will be eventually paid off. Let’s take a closer look at amortization tables and how they are used to plan a financial future.

What is amortization?

Amortization is the gradual reduction of your loan’s balance through regularly made payments. For home loans, this process helps borrowers and lenders maintain a clear understanding of the monthly mortgage payment and how each scheduled installment is distributed.

Most borrowers take out a loan with the goal of full amortization in mind. A fully amortized loan would result in the principal balance dwindling to zero at the conclusion of the loan’s term.

To reach the goal of full mortgage amortization, savvy borrowers will track their payment progression by closely following their amortization schedule.

What is an amortization schedule?

Amortization schedules help borrowers understand the amount they’ll be paying each month after they take out a loan. It also charts the breakdown of each payment, indicating how much of the installment goes towards interest vs. the loan’s principal.

Amortization schedules, provided by the lender when shopping for a loan, project your monthly payments throughout the full term of the mortgage. This chart also gives an estimate of how much equity you’ll have gained in a given month.

For a 30-year fixed rate mortgage, for example, your monthly payments will remain the same throughout the course of the loan. Although the amount paid for these mortgages doesn’t change from month to month, your amortization schedule would still be useful. By closely tracking your mortgage’s progress, you’ll understand exactly how much interest you’ve paid off and how much equity you’ll have gained on the property.

For the first few years of your loan, your amortization schedule will show the majority of your monthly payment going towards interest. This is typical for most loans, where more interest is due at the start of the loan’s term before the principal balance can be driven down.

Eventually, a higher portion of your payment will go towards driving down the loan’s balance. Your mortgage amortization schedule will show exactly how much your balance has decreased on a given date. With this knowledge, you can track your own equity in the property and project how much you’ll have gained in the future.

With a mortgage amortization schedule, you can get a head start on your long-term financial goals and prioritize savings years in advance.

What does an amortization schedule show?

Below you'll see a partial example of what an amortization schedule might look like for a $165,000 loan. We'll get more into what these sections mean a little later on.

| Payment Date | Payment | Principal | Interest | Total Interest | Balance |

| Jul 2021 | $836.03 | $217.28 | $618.75 | $618.75 | $164,782.72 |

| Aug 2021 | $836.03 | $218.10 | $617.94 | $1,236.69 | $164,564.62 |

| Sep 2021 | $836.03 | $218.91 | $617.12 | $1,853.80 | $164,345.71 |

| Oct 2021 | $836.03 | $219.73 | $616.30 | $2,470.10 | $164,125.98 |

| Nov 2021 | $836.03 | $220.56 | $615.47 | $3,085.57 | $163,905.42 |

| Dec 2021 | $836.03 | $221.39 | $614.65 | $3,700.22 | $163,684.03 |

| Jan 2022 | $836.03 | $222.22 | $613.82 | $4,314.03 | $163,461.82 |

| Feb 2022 | $836.03 | $223.05 | $612.98 | $4,927.01 | $163,238.77 |

| Mar 2022 | $836.03 | $223.89 | $612.15 | $5,539.16 | $163,014.88 |

| Apr 2022 | $836.03 | $224.72 | $611.31 | $6,150.46 | $162,790.16 |

Some of the information included on your amortization schedule can vary depending on your lender and the type of loan you take out, but they all typically display three important details:

- Scheduled payments

- Principal payment

- Interest

Let’s take a closer look at these elements to better understand mortgage amortization schedules:

Scheduled payments

The scheduled payment section of your schedule displays the total amount you will be expected to pay each month. For fixed-rate mortgages, the amount owed on your scheduled payments won’t change for the full course of the loan’s term.

While the overall amount paid would not change for a fixed-rate loan, the way those payments are distributed will differ from month to month. Your amortization table will display how each overall installment is broken down.

Principal payment

As a piece of the overall scheduled payment, the principal payment on your amortization table indicates how much of your mortgage bill is going towards bringing down the loan’s principal.

While the beginning of your mortgage term will largely be spent paying for interest on a loan, you will eventually begin to substantially bring down your loan’s balance as this share of your monthly payment increases.

The amortization schedule provided by your lender will show how much of your monthly payment is going towards the principal. This helps borrowers understand how much of their monthly payment goes towards the actual balance and when they can expect to start gaining equity at a faster rate.

Interest

Further breaking down the overall scheduled payments, the interest section on your amortization table will indicate how much of your installment is paying the cost of borrowing money.

Your loan payments will be mostly devoted towards interest at the beginning of your repayment plan, but as the amortization schedule shows, this balance begins to shift over time. As the amount devoted towards interest lessens, the principal balance becomes the focus of your payments.

Amortization and installment loans

Amortization schedules are especially useful when mapping out installment loans.

Installment loans are a type of financing that gets fully paid off after a period of time via regular payments. These loans are easily displayed on an amortization table since they have definite payment amounts and scheduled end dates.

Let’s take a look at the most common installment loans and how an amortization schedule can help you pay them off:

Fixed-rate mortgages

Fixed-rate mortgages feature an unchanging interest rate, making their amortization tables easy to follow.

With an unchanging monthly payment, fixed-rate mortgages offer a clear breakdown of each payment throughout the course of the loan’s term. For a 30-year fixed-rate mortgage, you’d be able to accurately project your monthly installments and equity gains for up to three decades.

This offers a huge advantage when planning for future financial endeavors. Many homeowners will leverage their home equity to take out a personal loan, using their amortization schedule to determine a borrowing strategy years in advance.

Having this foresight is a major advantage when planning your next investment or savings goal.

Personal loans

As another common installment loan type, personal loans are typically taken out with the expectation that the financing will be repaid in full.

While most personal loans feature a fixed payment plan, that is not always the case. Depending on your borrowing limits and eligibility, your lender might offer a variety of loan options.

No matter what type of personal loan you apply for, your loan amortization schedule will outline your payment distribution as well as the repayment timeline.

In conclusion

The most important part of taking out a loan is making sure you are able to repay the debt - an amortization table can help with that. Amortization schedules help borrowers stay on target when paying off their debts and them to keep their finances organized.

Loan amortization opens up new financial opportunities. After releasing yourself from debt through regularly made payments, you’ll have the flexibility to expand on your investment by taking out a personal loan.