Why choose a home renovation loan?

Renovation loans allow you to factor the cost of renovations into your mortgage with a single monthly payment, whether you’re interested in buying a fixer-upper or you want to update your current home.

Home renovation loan guidelines

To qualify for a home renovation loan, you will need:

- Minimum credit requirements apply.

- Income verification

- Cash on hand for a down payment

You can apply for a home renovation loan when buying a home or through a refinance of your current mortgage. For a purchase, you qualify for the loan including the cost of the desired improvements, but for a refinance, the loan amount is based on the value of the home after renovations are completed.

What are the current home renovation loan rates?

Your personalized mortgage rate will depend on several factors, including credit history and debt-to-income ratio. Apply for pre-approval today to get home renovation loan rates and start the borrowing process.

How to apply for a home renovation loan

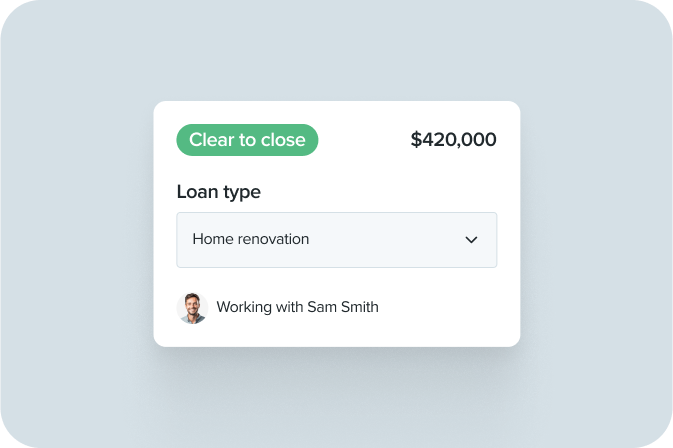

Applying for a home renovation loan is simple with Rate’s Digital Mortgage. Follow these steps.

1. Review your finances

Check your credit score, income, DTI ratio and cash on hand for a down payment.

1. Review your finances

Check your credit score, income, DTI ratio and cash on hand for a down payment.

2. Gather key documents

In most cases, you’ll need to provide income verification, tax returns, asset statements and personal identification.

3. Apply online

Once you submit your application, your Loan Officer will help you from there.

“The Guaranteed Rate Team was very easy to work with! Information was clear and all available through my portal for review at all times. Additionally the team was very responsive to any and all questions we had along the way.”

![[Cloned 08/14/25 11:56]: [Cloned 08/14/25 11:38]: testimonial - zillow](https://images.contentstack.io/v3/assets/blt4bf507db5c9bc5ae/blt117adfb03be9f144/687ab60580a8861e82d97030/zillow_logo-png.png)