The national average mortgage rate is

Your rate will vary based on credit score, debt-to-income ratio (DTI) and other factors. Personalize rates below by answering a few questions. You might even qualify for a lower rate based on the information you provide.

View historical mortgage rate trends

Recent data could give you a sense for where mortgage interest rates are headed.

Rates current as of .

How to apply for a mortgage

Applying for a mortgage is simple with Rate’s Digital Mortgage. Follow these steps.

1. Review your finances

Check your credit score, income, DTI ratio and cash on hand for a down payment.

1. Review your finances

Check your credit score, income, DTI ratio and cash on hand for a down payment.

2. Gather key documents

In most cases, you’ll need to provide income verification, tax returns, asset statements and personal identification.

3. Apply online

Once you submit your application, your Loan Officer will help you from there.

Mortgage rates guide & FAQs

Reach out to Rate loan experts who can answer even more questions and help you achieve your homeownership goals.

Mortgage rates FAQs

Mortgage interest rates describe how much you’ll pay for a home loan.

Your mortgage interest rate represents the percentage that lenders charge you to borrow money for a home. You will see it included as part of your monthly payment.

Getting the lowest rate requires timing and preparation. Improving your credit score or saving for a substantial down payment will help you get the lowest mortgage rate when the timing is right to apply for a loan.

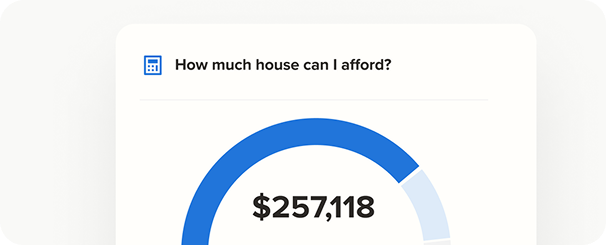

Understanding the full scope of your borrowing limits will also help you understand average mortgage rates. This will also help determine the best option for your situation.

APR shows the true cost of a loan, expressed as a percentage. It includes the interest rate and any additional fees such as closing costs or origination fees.

Mortgage refinance interest rates typically are similar to purchase interest rates, but there can be differences based on several factors. Consulting with a lender is your best option to ensure you get a mortgage rate that makes sense for your finances.

Locking the rate is an agreement between you and your lender that locks in your mortgage interest rate for a specific period of time, usually 30-60 days. It's intended to protect you in the event that rates rise before your loan closing.

Two of the main factors that will affect your loan qualification and mortgage interest rate are your financial history and credit score. Usually expressed as a number from 500 to 850, credit scores provide a summary of a borrower's history of managing debt and repaying loans.

A credit score shows a borrower’s financial background. It looks at how long they have had debt, their payment habits, types of credit, and other financial factors. Creditors will always use your credit score as one factor in your mortgage application.

Lenders set mortgage rates based on several factors, including market forces, the Federal Reserve, and borrower and loan profiles. Your credit score, down payment and debt-to-income ratio (DTI) also will affect the rate a lender will offer you.

“The Guaranteed Rate Team was very easy to work with! Information was clear and all available through my portal for review at all times. Additionally the team was very responsive to any and all questions we had along the way.”

Mortgage resources

We want to help you find a new home in your area and figure out how much you can afford.