Why choose a bank statement home loan?

A bank statement loan can be a mortgage solution for small-business owners, the self-employed, doctors, lawyers, real estate agents, investors and others who do not get regular paychecks, particularly if tax returns don’t reflect your true earning potential.

Bank statement home loan guidelines

Bank statement mortgage guidelines

- Credit score of at least 660

- 12 to 24 months of bank statements (personal or business)

- Down payment of at least 10%

You will also need a debt-to-income (DTI) ratio of 50% or lower, and you’ll need to provide additional details about your business. These requirements ensure you’re financially prepared and could improve your chances of securing a loan tailored to your needs.

How to apply for a bank statement home loan

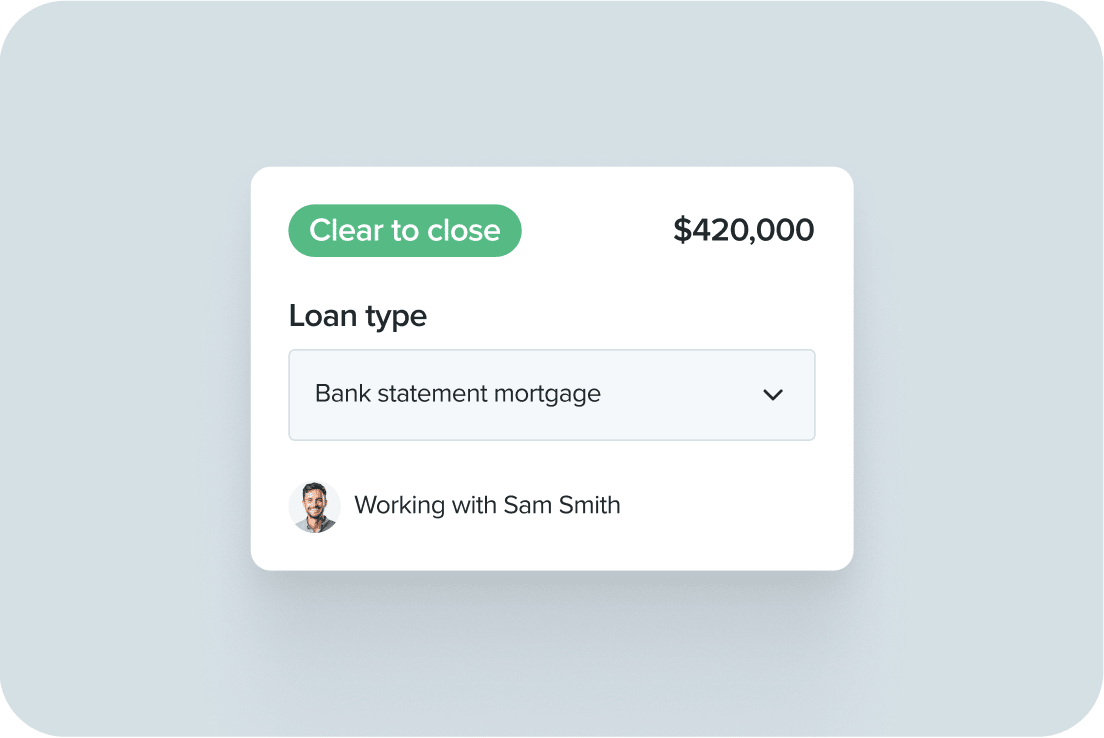

Applying for a bank statement mortgage is simple with Rate’s Digital Mortgage. Follow these steps.

1. Review your finances

Check your credit score, income, DTI ratio and cash on hand for a down payment.

1. Review your finances

Check your credit score, income, DTI ratio and cash on hand for a down payment.

2. Gather key documents

In most cases, you’ll need to provide income verification, tax returns, asset statements and personal identification.

3. Apply online

Once you submit your application, your Loan Officer will help you from there.

“The Guaranteed Rate Team was very easy to work with! Information was clear and all available through my portal for review at all times. Additionally the team was very responsive to any and all questions we had along the way.”

Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee. Restrictions may apply.

Available for owner occupied, second home or investment properties. Property type restrictions apply. 1099 and 12 month bank statement income qualification is available. Applicant subject to credit and underwriting approval. Additional restrictions apply.