Full doc home loan benefits & guidelines

A “full doc,” or fully documented, home loan could offer lower mortgage interest rates and flexible terms. While gathering required documents may take time, they help demonstrate your financial credibility and give lenders confidence in your ability to manage the loan.

Why choose a full doc loan?

Full doc home loans offer lenders a clear picture of your financial stability, which could allow you to secure more competitive mortgage rates and flexible loan options, whether you’re purchasing a home, refinancing or investing in real estate.

Full doc mortgage guidelines

To qualify for a full doc mortgage, you will need:

- Proof of income

- Full asset verification

- Cash on hand for a down payment

Full doc home loans require you to provide bank or investment account statements to prove you have funds for the down payment and closing costs. Lenders will also review your credit history and typically require a minimum credit score to assess your repayment reliability.

How to apply for a full doc mortgage

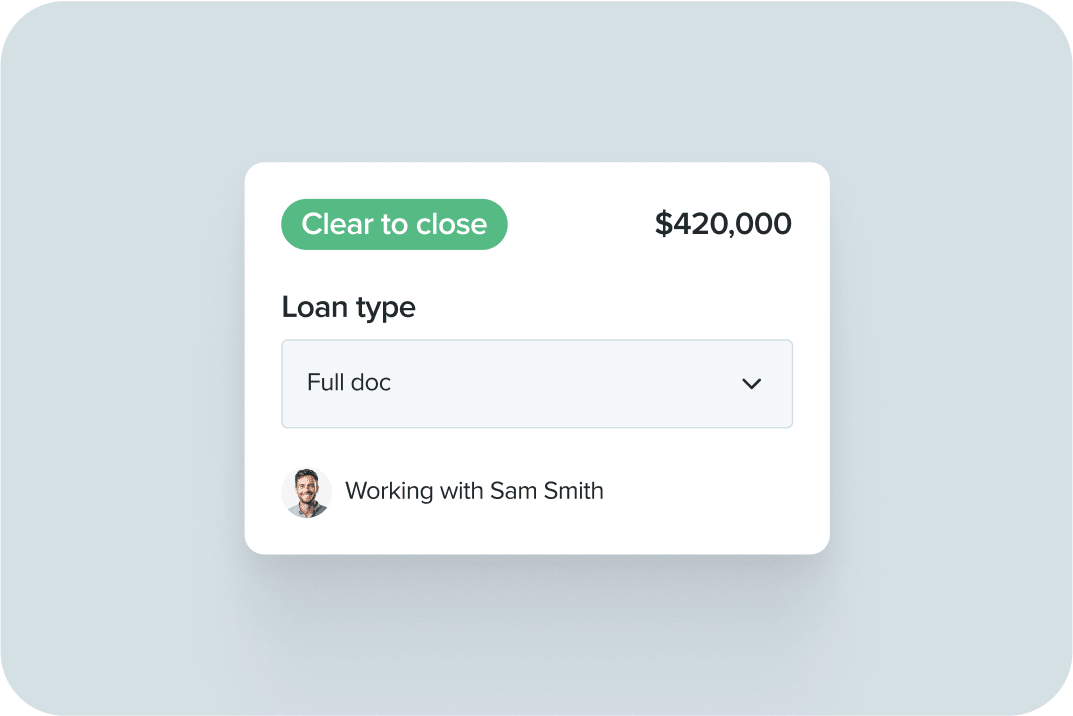

Applying for a full doc mortgage is simple with Rate’s Digital Mortgage. Follow these steps.

1. Review your finances

Check your credit score, income, DTI ratio and cash on hand for a down payment.

1. Review your finances

Check your credit score, income, DTI ratio and cash on hand for a down payment.

2. Gather key documents

In most cases, you’ll need to provide income verification, tax returns, asset statements and personal identification.

3. Apply online

Once you submit your application, your Loan Officer will help you from there.

“The Guaranteed Rate Team was very easy to work with! Information was clear and all available through my portal for review at all times. Additionally the team was very responsive to any and all questions we had along the way.”

Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee. Restrictions may apply, contact Rate for current rates and for more information. All information provided in this publication is for informational and educational purposes only, and in no way is any of the content contained herein to be construed as financial, investment, or legal advice or instruction.

Rate, Inc. does not guarantee the quality, accuracy, completeness or timelines of the information in this publication. While efforts are made to verify the information provided, the information should not be assumed to be error free. Some information in the publication may have been provided by third parties and has not necessarily been verified by Rate, Inc.

Rate, Inc. its affiliates and subsidiaries do not assume any liability for the information contained herein, be it direct, indirect, consequential, special, or exemplary, or other damages whatsoever and howsoever caused, arising out of or in connection with the use of this publication or in reliance on the information, including any personal or pecuniary loss, whether the action is in contract, tort (including negligence) or other tortious action. Rate does not provide tax advice. Please contact your tax adviser for any tax related questions.