Self-employed 1099 home loan benefits & guidelines

A self-employed home loan allows you to qualify based on your real income, not just pay stubs. If you are a freelancer, contractor or business owner, this loan option could help you buy a home without giving up your entrepreneurial lifestyle.

Self-employed 1099 mortgage guidelines

To qualify for a self-employed 1099 mortgage, you will need:

- Minimum credit score of 620

- 1099 documents

- Cash reserves for down payment

Lenders often look for at least two years of self-employment history, but if you’ve recently transitioned into self-employment within the same field, exceptions may be made.

How to apply for a self-employed 1099 mortgage

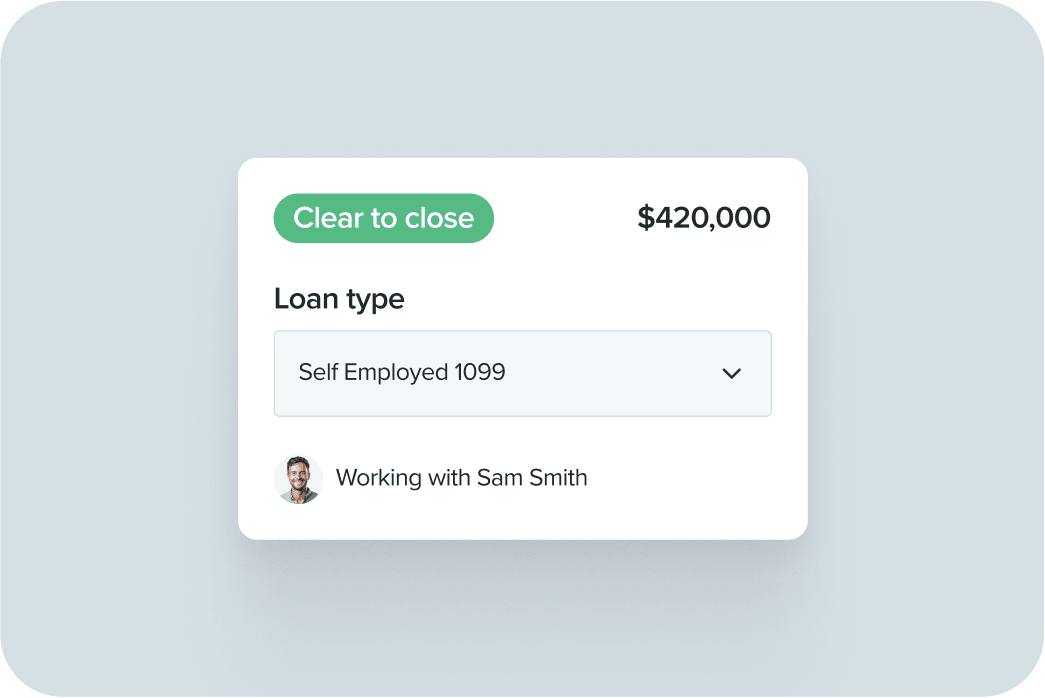

Applying for a self-employed 1099 mortgage is simple with Rate’s Digital Mortgage. Follow these steps.

1. Review your finances

Check your credit score, income, DTI ratio and cash on hand for a down payment.

1. Review your finances

Check your credit score, income, DTI ratio and cash on hand for a down payment.

2. Gather key documents

In most cases, you’ll need to provide income verification, tax returns, asset statements and personal identification.

3. Apply online

Once you submit your application, your Loan Officer will help you from there.

“The Guaranteed Rate Team was very easy to work with! Information was clear and all available through my portal for review at all times. Additionally the team was very responsive to any and all questions we had along the way.”

Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee. Restrictions may apply.

Available for owner occupied, second home or investment properties. Property type restrictions apply. 1099 and 12 month bank statement income qualification is available. Applicant subject to credit and underwriting approval. Additional restrictions apply.